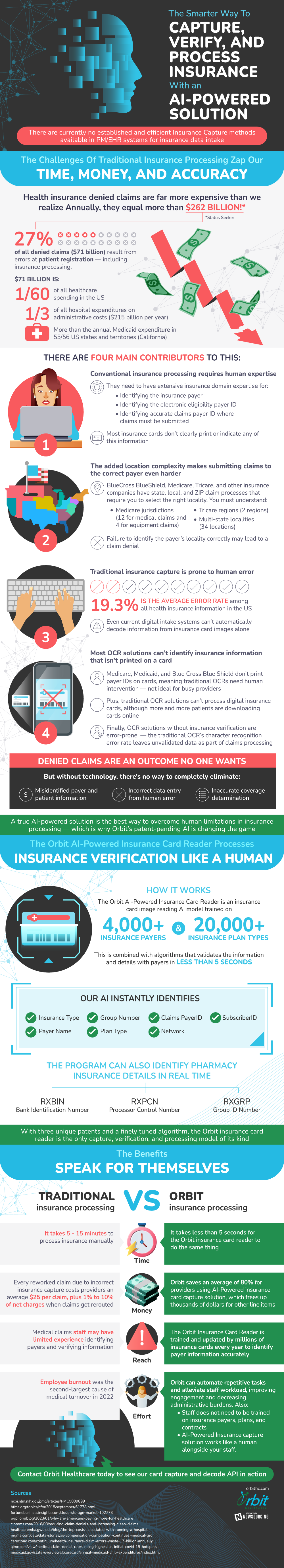

The insurance industry is in dire need of a smarter way to capture, verify, and process insurance. There are currently no established and efficient methods, and many of the traditional methods lack efficiency and accuracy. In fact, denied claims due to error equate to over $260 billion annually.

The main contributors to this lack in the insurance industry lie in limitations. Both in the software currently in use as well as limitations in human capability. Conventional insurance processing requires human expertise. This means that extensive knowledge and experience in the field is required, limiting the number of people who are capable of completing necessary tasks. When humans are forced to intervene in insurance processing, the change for error increases. This error rate is currently above 19% in the healthcare field, emphasizing the struggles that many companies face with accuracy. Aside from human error, most current solutions are limited to identification based on information printed on a card. This leaves out much of the vital information that modern insurance holders need to be effective.

Due to these grievances, experts are working on developing an AI powered insurance card capture solution that can overcome the current limitations in insurance processing. Artificial intelligence can identify a multitude of facts about a plan or insurance holder, and can do it in seconds. Gone are the days of waiting when it comes to insurance, as AI is paving the way for a new era of the industry.

Source: OrbitHC